As Business Owners we are often faced with interferences with our business and some of these interruptions can result in a Loss of Profits, leaking thousands of Rands, if not insured correctly.

One extension specifically is often over looked and that is Prevention of access.

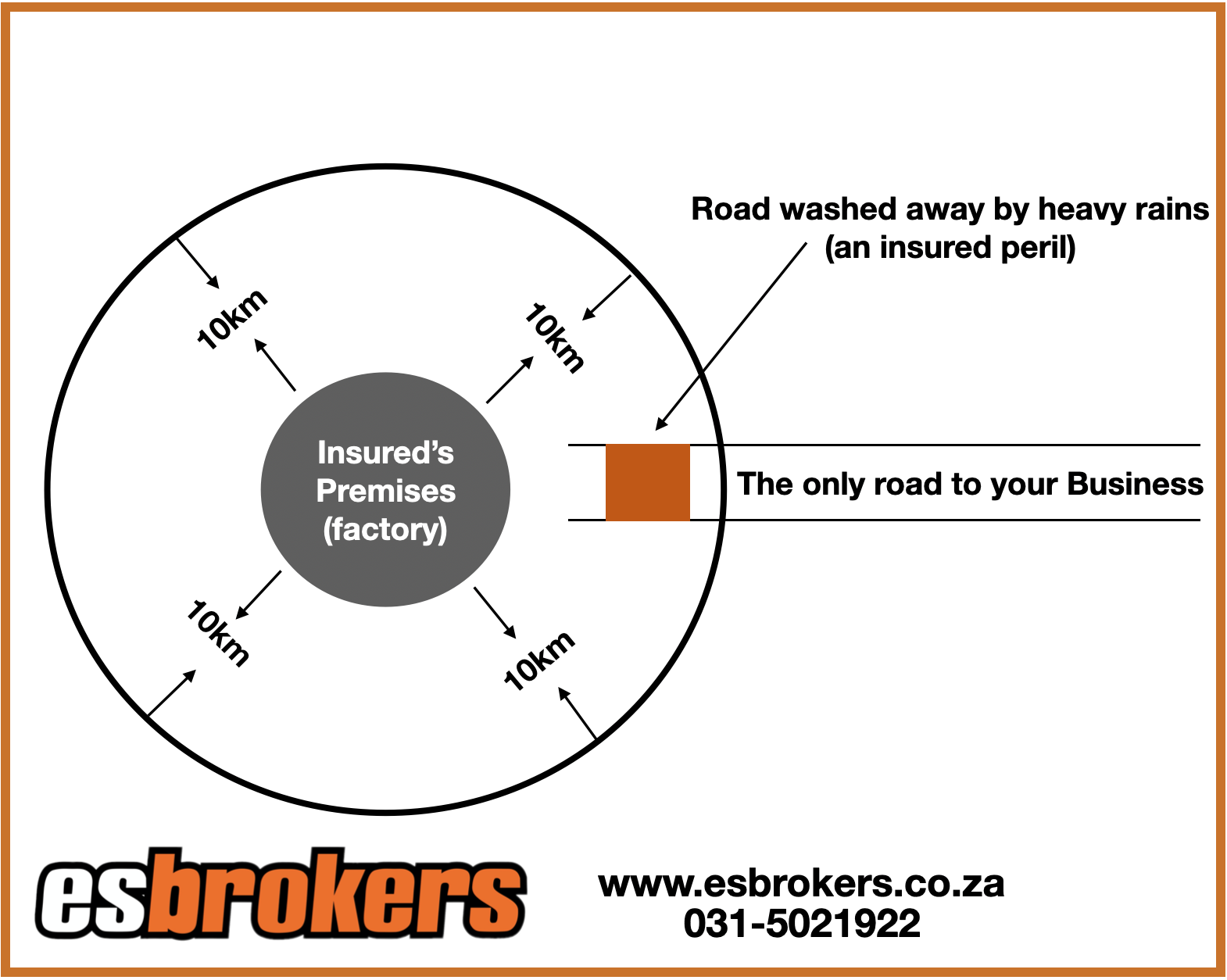

What would happen to the clients business premiums if ( within a 10 km radius) there is destruction of or damage to, which shall prevent or hinder the use of the premises or prevent access, whether the premises or property of the insured be damaged or not?

Here are some examples of what could happen in this scenario:

* what if a bridge that belongs to a local authority, within a radius of 10 kilometers washes away preventing access in or out to your business

* On in this case the insured runs a shop in a shopping centre with only one access door. As a result of a fire near the entrance, and consequent damage to the structure, it has become too dangerous for use by the public. The centre therefore has to be closed for two weeks.

* Or the insured runs a factory in an industrial area with only one access route. Access is controlled by security guards. An underground water pipe bursts right next to the access control point. It takes the local authority a week to repair the pipe and the access route.

Now you can go one step further and also select Prevention of access – extended cover

Again the radius has to be within a 10 km radius of the premises. This point refers only to the premises. This therefore means any premises where the insured's items or goods are temporarily found, and access thereto is prevented, for example the premises of suppliers or clients.

Ask your Broker to make sure this extension is included. Remember if it is not stated on the schedule to be included don’t assume it is. This extensions must be requested and an additional premium is charged.

For any assistance regarding the information above please feel free to phone our office on 031-5021922 or leave your details on our website www.esbrokers.co.za.

Article written by Andrew Ensor-Smith (Director of ES Brokers)